Financial Reset, Plan Now for a Successful 2025

As businesses prepare for a fresh start in 2025, robust financial planning becomes essential. A thorough review of past performance combined with strategic goal setting ensures a strong foundation for growth. Start by revisiting your 2024 financial objectives and assessing what worked and what didn’t. Use these insights to set SMART goals that are specific, measurable, achievable, relevant, and time-bound. Whether your focus is on increasing profit margins, scaling operations, or exploring new markets, clear and actionable goals will serve as your financial roadmap for the year ahead.

A well-structured budget is key to financial stability and growth. Analyze your 2024 income and expenses to identify inefficiencies, trends, and opportunities for cost savings. Use this data to create a realistic 2025 budget that prioritizes high-growth areas and builds reserves for innovation. In parallel, leverage tax planning strategies to maximize profitability. Consult with tax professionals to explore deductions, credits, and income optimization techniques. Actions like investing in equipment or increasing retirement contributions can result in significant tax savings, freeing up capital for other strategic initiatives.

Reassess your business investments to ensure they align with your strategic goals and deliver the desired returns. Diversify your portfolio by exploring new revenue streams, such as e-commerce or digital tools, to reduce market volatility risks. Simultaneously, build a business emergency fund equivalent to at least three months of operating expenses. This safety net will provide financial resilience against unexpected disruptions, such as economic downturns or supply chain challenges, ensuring operational continuity in uncertain times.

Reassess your business investments to ensure they align with your strategic goals and deliver the desired returns. Diversify your portfolio by exploring new revenue streams, such as e-commerce or digital tools, to reduce market volatility risks. Simultaneously, build a business emergency fund equivalent to at least three months of operating expenses. This safety net will provide financial resilience against unexpected disruptions, such as economic downturns or supply chain challenges, ensuring operational continuity in uncertain times.

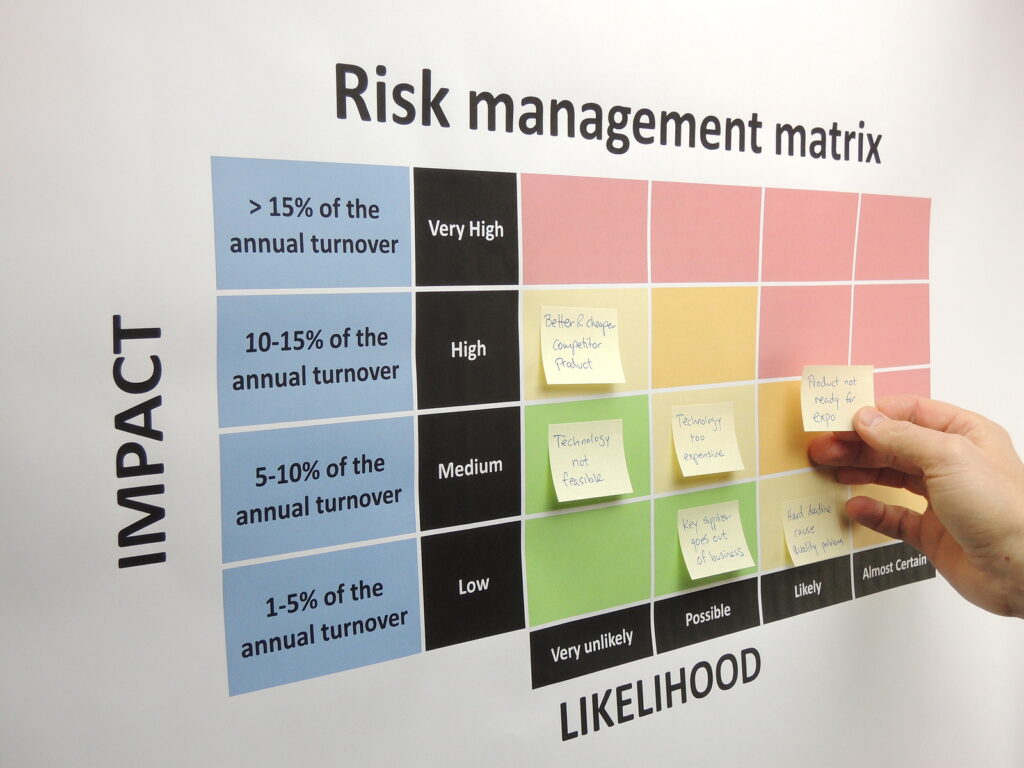

Effective financial planning requires proactive risk management. Review your insurance coverage to ensure it reflects current business needs, particularly if you’ve expanded operations or made significant changes. Comprehensive coverage for property, liability, and employee benefits protects your assets and minimizes exposure to risks. Additionally, focus on debt management by prioritizing the repayment of high-interest loans or exploring refinancing options. A strategic approach to debt not only reduces financial stress but also strengthens your credit profile, paving the way for future funding opportunities.

Effective financial planning requires proactive risk management. Review your insurance coverage to ensure it reflects current business needs, particularly if you’ve expanded operations or made significant changes. Comprehensive coverage for property, liability, and employee benefits protects your assets and minimizes exposure to risks. Additionally, focus on debt management by prioritizing the repayment of high-interest loans or exploring refinancing options. A strategic approach to debt not only reduces financial stress but also strengthens your credit profile, paving the way for future funding opportunities.

Financial planning is as much about creating opportunities as managing resources. Allocate funds to skill development, employee training, and technology upgrades to boost efficiency and competitiveness. Regularly monitor your financial progress using analytics tools to track key performance indicators like revenue growth and profit margins. Reflect on successes and lessons learned to make informed adjustments throughout the year. By maintaining consistency and focus, your business will be well-positioned for innovation, growth, and profitability in 2025 and beyond. Strategic preparation today ensures a prosperous tomorrow.

Business Article

Call us today on Tel: +254724740527 to learn more about how our weekly digital marketing newsletter can help your business succeed.

You Can Also Get To Us Through Our Email Address: mansoor@goplacesonline.com

Follow us on our social media platforms: